The U.S. trade actions over the last few months have shown that Ontario can no longer assume the benefits of its economic partnership with the United States. This is why, to protect Ontario’s economy, the government is preparing for the challenge ahead. This starts with Ontario’s ambitious plan to unleash the province’s enormous economic potential and transform the economy to help make Ontario the most competitive place to invest and do business in the G7.

Building a More Competitive, Resilient and Self-Reliant Economy

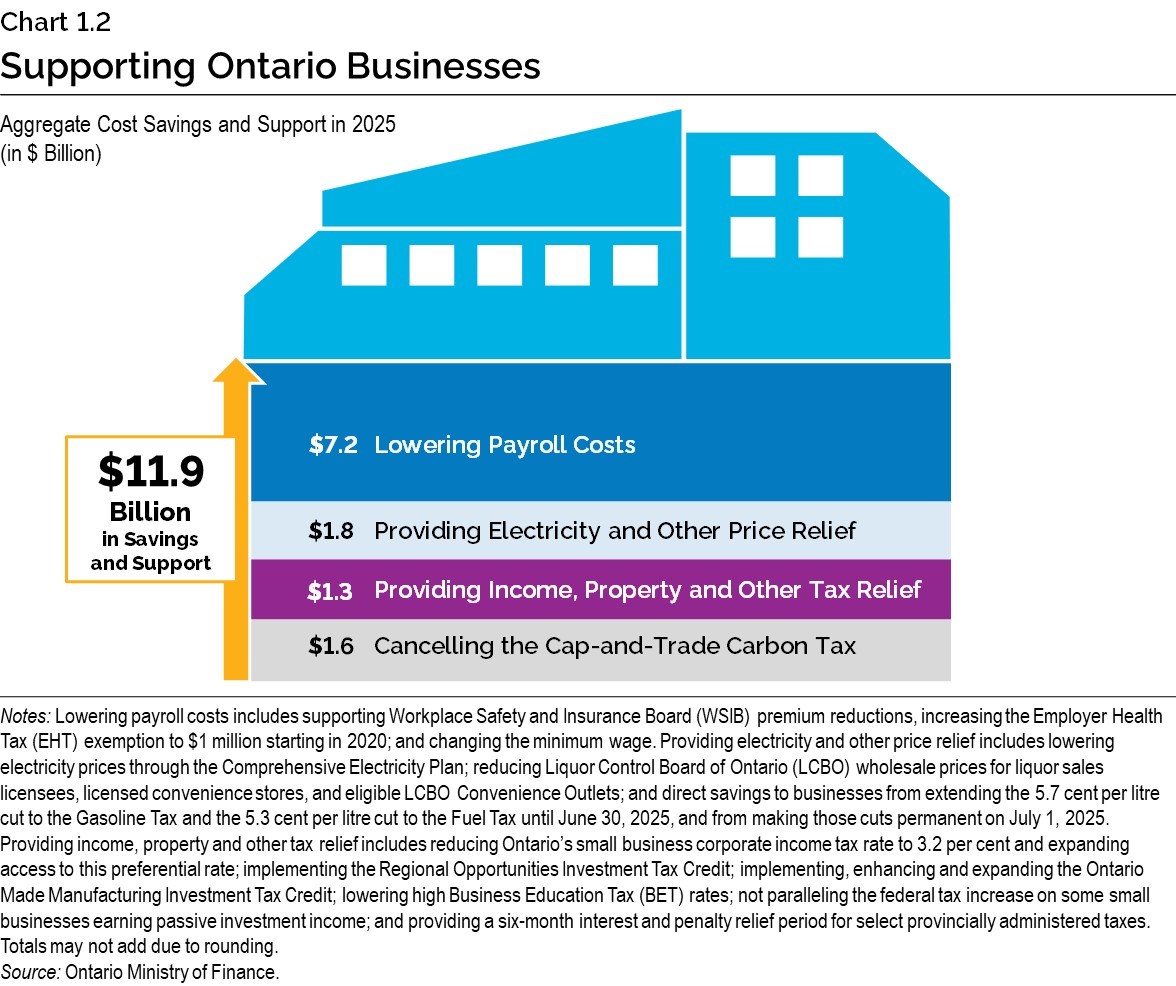

Since 2018, Ontario has welcomed nearly $70 billion in investments across key sectors, helped to create nearly one million new jobs, and lowered costs for businesses through actions that include cutting taxes and lowering electricity prices. The actions the government has taken would enable an estimated $11.9 billion in savings and supports for Ontario businesses in 2025. This will help companies start and grow their businesses, creating better jobs and bigger paycheques for workers across Ontario.

The government is continuing to enhance Ontario’s competitiveness by supporting investments in manufacturing, expanding interprovincial trade, increasing the province’s electricity capacity, encouraging innovation, and helping small businesses thrive. In addition, Ontario is taking steps to unlock the critical mineral resources needed to supply its industries and build the critical infrastructure needed to get them there.

Taking Action to Protect Manufacturing Jobs and Attract Investment

Ontario has attracted nearly $70 billion in new investments across the manufacturing, life sciences and technology sectors. However, U.S. tariffs and protectionism are putting this progress at risk and disrupting industries that provide good jobs in communities across the province. The government will meet these challenges by continuing to incentivize investment in high-priority sectors.

Increasing Support for Ontario Manufacturers and Processors

As part of the 2023 Budget, the government announced the Ontario Made Manufacturing Investment Tax Credit (OMMITC) to support qualifying Canadian-controlled private corporations (CCPCs) making eligible investments in buildings, machinery and equipment for use in manufacturing or processing in the province. It is estimated that the OMMITC will provide about $1.4 billion in income tax support to Ontario’s manufacturers and processors by 2027–28.

As part of the government’s commitment to protect manufacturing jobs, the government is proposing to temporarily enhance the OMMITC for CCPCs and expand access to the OMMITC to non-Canadian-controlled private corporations (non-CCPCs) making eligible investments in Ontario.

The temporary enhancement would increase the rate of support for eligible expenditures by CCPCs from 10 per cent to 15 per cent. Under the temporary expansion, non‑CCPCs would be able to access the OMMITC as a 15 per cent non-refundable corporate income tax credit. Eligible expenditures would mirror those eligible for the existing OMMITC that are made on or after May 15, 2025, and before 2030. Through these proposed changes, a corporation could receive a tax credit of up to $3 million per year.

By enhancing and expanding the OMMITC, the government would be providing an additional $1.3 billion over three years in estimated support to help lower costs for businesses that invest in buildings, machinery and equipment that are used for manufacturing and processing in Ontario. In the wake of U.S. tariffs and the impacts they may have on Ontario’s manufacturing sector, this additional support would help increase the competitiveness and resilience of the sector, helping to protect and create good-paying manufacturing jobs.

Detailed legislation for these proposed changes would be introduced as part of the 2025 Ontario Economic Outlook and Fiscal Review.

See the Annex: Details of Tax Measures and Other Legislative Initiatives for more information.

Boosting the Province’s Competitiveness Through Invest Ontario

As U.S. tariffs continue to create investment uncertainty for businesses, the government is committed to providing greater economic stability and resilience by supporting major investments in the province through Invest Ontario. As the province’s investment attraction agency, Invest Ontario promotes Ontario as a top-tier destination for domestic and global investment, by providing investors with key information about Ontario’s business supports and program services. In addition, the agency offers financial support through its $700 million Invest Ontario Fund to help businesses locate or expand in the province, with a focus in key sectors such as advanced manufacturing, life sciences and technology. To date, Invest Ontario has announced over $7.5 billion in investments, which are expected to create almost 9,500 jobs.

To continue securing major investments, the government is allocating an additional $600 million to the Invest Ontario Fund to provide the agency greater stability in executing its mandate of job creation and investment attraction. The additional funding will help increase the agency’s responsiveness to current economic challenges by providing greater certainty to investors and helping to ensure Ontario stays competitive on the global stage.

Expanding Ontario’s Shipbuilding Industry

Growing the shipbuilding industry is one part of Ontario’s strategy to strengthen the province’s position as a leader in marine transportation, as outlined in The Future of the Great Lakes Economy: Ontario’s Marine Transportation Strategy.

The Ontario government is investing over $200 million to support the shipbuilding industry and the broader marine sector, starting with the new Ontario Shipbuilding Grant Program. The program will provide non-repayable grants to Ontario shipbuilders for projects that support the shipbuilding industry’s competitiveness, business growth and long-term capacity. The grant program will directly benefit Ontario-based shipbuilding companies and their employees by supporting skills training, the purchase of machinery and equipment, and infrastructure improvements.

Enhancing the competitiveness of Ontario’s shipbuilding industry and the broader marine sector is key to unlocking the untapped potential of the sector and fostering economic development throughout different regions of the province, including Northern Ontario. Strengthening the province’s shipbuilding industry is also critical to enhancing Ontario’s economic competitiveness, including for federal procurements to support Canada’s shipbuilding capacity under the federal National Shipbuilding Strategy.

Ontario calls on the federal government to recognize the important role that Ontario shipbuilders can play in the National Shipbuilding Strategy to bolster Canada’s domestic shipbuilding capabilities, as well as supporting Canada in meeting and exceeding its two per cent of GDP NATO spending target as part of national defence commitments.

Unleashing the Economic Potential of Critical Minerals

The imposition of U.S. tariffs has highlighted the urgent need to bolster Ontario’s economic resilience. This includes greater emphasis on domestically sourced critical minerals to maintain secure supply chains and unleash Ontario’s economy.

Critical minerals, such as copper, lithium, nickel, cobalt, graphite and rare earth elements, are the foundation upon which modern technology is built. Rapidly changing technologies are, in turn, increasing the global demand for critical minerals, which have become important to strategic industries, including in the defence, aerospace, automotive and energy sectors.

Unlocking the Ring of Fire

The Ring of Fire is one of Ontario’s greatest assets in the face of economic threats from the United States. Covering approximately 5,000 square kilometres, the Ring of Fire contains one of the most promising mineral development opportunities in the world, representing enormous economic potential. The region includes reserves of chromite, copper, cobalt, nickel, platinum and many other critical minerals that play a significant role in supporting innovative technologies, including electronics, EVs and cleantech.

Supporting development in the Ring of Fire area will help ensure that Northern communities reap the benefits of critical mineral development, and that First Nation communities benefit through partnerships that offer economic opportunities spanning generations.

As Ontario invests in and makes progress on developing critical infrastructure in the Ring of Fire region, the provincial government continues to call on the Government of Canada to match Ontario’s funding commitments and expedite approval processes for all infrastructure that would enable the development of the Ring of Fire and generate considerable economic benefit to Indigenous and Northern communities.

The current permitting and authorization processes for mining and major infrastructure projects require proponents to navigate a complex process of overlapping and duplicative approvals from multiple ministries and levels of government. In April 2025, the Legislature introduced the Protect Ontario by Unleashing Our Economy Act, 2025, which, if passed, would cut the red tape and duplicative processes that have held back major infrastructure, mining and resource development projects, including in the Ring of Fire. A key component of this legislation is a new One Project, One Process permitting model that streamlines approval processes across government to one process, with the intent of reducing government review time by 50 per cent. Ontario is looking forward to working with the Government of Canada on the One Project, One Review commitment to sign Cooperation and Substitution Agreements, within six months, with all willing Premiers, as well as Indigenous Governing Bodies, allowing the federal government to recognize provincial-, territorial-, and Indigenous-led assessments.

Attracting Investments to Accelerate Ontario’s Critical Minerals Processing Capacity

As the government accelerates the development of critical minerals projects in Ontario, it is also working to attract historic investments to support critical mineral processing capacity here at home, to help ensure that minerals mined in Ontario will be processed in Ontario, by Ontario workers. The government will help unleash the potential of the province’s critical minerals sector by investing $500 million to create a new Critical Minerals Processing Fund (CMPF). Through the fund, Ontario will provide strategic financial support for projects that will accelerate the province’s critical minerals processing capacity, offering a stable supply of critical minerals mined in Ontario, to be used in the province’s broader manufacturing base, while also capitalizing on growing global demand.

The CMPF will capture greater economic value from the province’s mineral resources, by helping to ensure existing mineral processing facilities are fully utilized, as well as supporting the construction of new processing facilities in Ontario. Instead of being extracted only to be shipped to other jurisdictions for higher value-added processing, minerals mined in Ontario will be refined in Ontario. This will help create new opportunities for workers in Indigenous communities and Northern hubs such as Thunder Bay, Sault Ste. Marie, Sudbury, North Bay and Timmins.

By enhancing Ontario’s processing capacity, the province can attract greater private capital investment and speed up key strategic projects across the critical minerals supply chain. A fully integrated supply chain will improve Ontario’s standing as a global leader in critical minerals, making the province a more attractive jurisdiction for investment, and a secure source of supply of critical minerals.

In addition, as described in the section “Toughening Up on Short Selling,” the Ontario Securities Commission (OSC) and the Canadian Investment Regulatory Organization (CIRO) are taking action by making changes to the short selling regime that will strengthen Ontario’s public capital markets and help support capital raising, including for the mining sector.

Continuing to Invest in Ontario’s Junior Mining Companies and Exploration

The government is investing $10 million more in 2025–26 to extend the Ontario Junior Exploration Program (OJEP), which helps junior mining companies cover eligible costs for critical and precious mineral exploration and development. These projects have the potential to lead to promising discoveries of valuable mineral deposits that could become future mining operations, boosting economic growth and job creation for Northern and Indigenous communities.

This investment builds on the $35 million already committed to OJEP, as announced in November 2024. This includes $23 million to support exploration of all types of minerals and $12 million invested in a stream dedicated to supporting the discovery and development of critical minerals that will help build an integrated supply chain for new technologies. Through the most recent round of OJEP funding, the government is helping 84 junior mining companies finance early exploration projects, with 62 of them focused on the exploration of critical minerals.

Supporting Innovation in the Critical Minerals Supply Chain

In November 2022, the government launched the Critical Minerals Innovation Fund (CMIF) as part of its Critical Minerals Strategy. The fund helps increase critical minerals exploration, mining, development, production and processing by stimulating investment in Ontario’s critical minerals supply chain. To date, Ontario has invested $20 million through the CMIF to support projects that involve research, development and commercialization of innovative technologies, techniques, processes and solutions.

The government is now investing an additional $5 million over two years in the CMIF starting in 2025–26, to encourage innovation in the critical minerals sector and reduce reliance on foreign sources of critical minerals and their processing. The funding will help stimulate investment in the critical minerals supply chain and enhance collaboration between industry, academia, startups, and R&D firms.

Recovering Residual Metals and Minerals from Mine Waste

In November 2024, the government announced the introduction of a new regulation under the Mining Act that would make it easier to recover residual metals and minerals from mine waste that could be found at operating, closed or abandoned mine sites. Mining waste contains byproducts left over from the extraction of metals like nickel, copper and gold, which may contain small amounts of critical minerals like lithium, platinum and cobalt previously considered uneconomical to recover. This new regulation supports Ontario’s Critical Minerals Strategy by providing sufficient flexibility to allow for the reprocessing of mine waste and streamlining the application process for permits, while ensuring health, safety and environmental protection. Once the new regulation comes into force on July 1, 2025, Ontario will become the first jurisdiction in Canada to enable a dedicated regulatory pathway to recover residual minerals from mine waste.

Strengthening Indigenous Partnerships

Ontario’s progress relies on strong Indigenous partnerships. This includes a focus on sharing in the economic opportunities from critical minerals and electricity sector investments.

The government is relaunching the province’s existing $1 billion Aboriginal Loan Guarantee Program (ALGP) as the new $3 billion Indigenous Opportunities Financing Program (IOFP) to support Indigenous participation in more sectors, including electricity, critical minerals, resource development and related infrastructure components, offering generational economic opportunities for Indigenous Peoples in Ontario.

The name of the program was changed to the IOFP to signal the future design of other financing tools to support Indigenous participation. The proposed changes are key to building a stronger, more resilient and self-sufficient economy and strengthening the participation of Indigenous partners in major infrastructure projects in Ontario.

The program will be transferred in full, with program oversight and administration, from the Ontario Financing Authority (OFA) to the Building Ontario Fund (BOF). The BOF has the legislative mandate to work with institutional investors and Indigenous partners, and has the necessary expertise, investment framework, and resources to act as a single-entry point for Indigenous partners across Ontario, to access financing for infrastructure projects.

The transfer will occur in Q2 of the 2025–26 fiscal year and further details will be shared in the coming months. The program will continue to operate as before, during and after the transition period, to support Indigenous partners in accessing low-cost capital.

Expanding the Indigenous Participation Fund

The government is continuing to advance responsible and sustainable mineral exploration and development with the participation of Indigenous communities by investing $70 million over four years in the Indigenous Participation Fund (formerly known as the Aboriginal Participation Fund), starting in 2025–26. This investment will support Indigenous communities and organizations in areas of high mineral activity to improve capacity for participation in regulatory processes related to mineral exploration and mine development.

This investment will provide greater capacity support to Indigenous communities to enable meaningful consultation, which will help open new mines. This would also better equip Indigenous communities to leverage economic opportunities through increased participation in Ontario’s growing minerals sector, while helping to support the North American supply chains needed for the deployment of new technologies, as well as the maintenance and expansion of existing infrastructure.

Creating Resource Development Scholarships for First Nation Students

The government is investing $10 million over three years to create new scholarship opportunities for First Nation students interested in pursuing careers in resource development. Ontario’s colleges, universities and Indigenous Institutes play a key role in ensuring Ontario’s mining sector has a highly skilled workforce to drive its economy. As the government continues to take vital steps to unlock Northern Ontario’s mining potential, these scholarships will equip First Nation students with access to the tools and training needed to succeed as leaders and innovators in this sector.

Expanding Trade Opportunities for Ontario’s Exporters

U.S. trade protectionism and the uncertainty it brings present significant challenges for Ontario firms and industries, particularly those with deeply integrated supply chains across the border. However, these challenges also create opportunities for firms to diversify and expand to new markets. The government is ready to help businesses realize those opportunities.

Leading the Country on Interprovincial Free Trade

Trade with other provinces is a significant contributor to Ontario’s economy, with the potential to support stronger growth for the province and the country. In 2024, Ontario exported nearly $196 billion in goods and services to other provinces, representing 16.7 per cent of Ontario’s total trade, and imported nearly $144 billion in goods and services from other provinces. Together, total interprovincial trade amounted to $339.5 billion, equivalent to nearly 30 per cent of Ontario’s nominal GDP.

However, barriers to interprovincial trade have held back Ontario’s economy from reaching its full potential. Reducing these barriers, especially at times of economic uncertainty, can lower business costs and increase labour mobility, which reduce inflationary pressures. Reducing barriers to trade will also boost competitiveness and productivity, while creating new jobs.

The Ontario government is reducing unnecessary barriers and taking a leadership role in driving immediate and meaningful action on internal trade. As announced in April 2025, the government has introduced the Protect Ontario Through Free Trade Within Canada Act, to unlock free trade and labour mobility across Canada, including measures that would:

- Remove all its party-specific exceptions under the Canadian Free Trade Agreement (CFTA);

- Remove labour mobility barriers, reduce administrative burdens and simplify the movement of certified workers across Canada, by expanding labour mobility with new “As of Right” rules;

- Enable mutual recognition with reciprocating provinces and territories, so that goods, services and registered workers that are good enough for other parts of Canada are recognized as good enough for sale, use or work in Ontario;

- Move to allow more regulated health professionals to begin practising in Ontario and removing restrictions using “As of Right” rules;

- Enable direct-to-consumer alcohol sales with reciprocating provinces and territories so that consumers will be able to purchase alcohol directly from producers across Canada for personal consumption; and

- Establish a “Buy Ontario, Buy Canadian” day held annually on the last Friday in June to help consumers support local businesses and workers through programs such as Ontario Made, Ontario Wood, Vintners Quality Alliance (VQA) for wine, and Foodland Ontario.

These measures will help expand the opportunities for Ontario businesses and workers and support economic integration across Canada. And in doing so, the new legislation, if passed, would support a stronger, more resilient economy for the people of Ontario that is less reliant on trade with the United States.

Supporting Exports Through the Ontario Together Trade Fund

Many Ontario manufacturers are heavily integrated into U.S. supply chains through long-term and complex supply contracts. They face significant challenges in re-orienting production to new markets and customers in order to mitigate the impact of U.S. tariffs. As well, Ontario’s small and medium-sized manufacturing enterprises have experienced challenges raising capital to make investments in industry-leading technologies.

In April 2025, Ontario announced an investment of $50 million over three years starting in 2025–26 to create the Ontario Together Trade Fund (OTTF). This new program will help businesses develop new markets and re-shore critical supply chains, strengthening Ontario’s trade security and diversification. In particular, the OTTF will focus on expanding interprovincial trade by supporting investments in infrastructure, equipment and processes to enhance competitiveness in the face of U.S. tariffs.

Expanding International Trade Opportunities

To help strengthen and diversify trade, the government continues to promote Ontario-made goods and services and support export opportunities. In November 2024, Ontario concluded a successful mission to Singapore, showcasing the province’s growing life sciences, technology and automotive sectors, while strengthening the economic partnership between both jurisdictions. The trade mission also marked the official opening of Ontario’s first Trade and Investment Office (TIO) in the Association of Southeast Asian Nations (ASEAN) region.

Ontario has 14 international TIOs around the world, which work closely with Canadian federal, provincial/territorial and municipal partners to raise the commercial profile of Ontario, facilitate investment deals and help the province’s SMEs expand their export capacity in global markets. Since 2018, Ontario’s international network of TIOs has attracted nearly $25.9 billion in new investments and facilitated market access for over 1,900 Ontario companies from various industry sectors.

Powering Ontario’s Affordable Future

Ontario’s energy policy will determine the success of the province’s economy, today and for a generation to come.

According to Ontario’s Independent Electricity System Operator (IESO) October 2024 forecast, the province’s electricity demand is expected to grow by 75 per cent by 2050, the equivalent of adding four and a half cities the size of Toronto to the grid.

Ontario is investing in new energy production, transmission and storage, leading the largest expansion of electricity generation in more than 30 years, and transforming Ontario into an energy superpower.

Planning and Building the Future of New Nuclear

The government is advancing four small modular reactors (SMRs), the first of their kind in the G7, at the existing Darlington nuclear site, which would provide a total of 1,200 megawatts (MW) of electricity generation, enough power for 1.2 million homes. In April 2025, Ontario Power Generation (OPG) received a power reactor construction licence for Unit One from the Canadian Nuclear Safety Commission (CNSC). This approval is a major milestone for the project, which could create and sustain up to 2,000 jobs each year during the 65 years of operations and contribute over $13 billion to the province’s GDP.

Ontario is also exploring opportunities for new large-scale nuclear energy generation, both at the Bruce Nuclear Generating Station site in Bruce County and at OPG’s Wesleyville site in Port Hope. These potential projects could add up to 4,800 MW and 10,000 MW, respectively, which combined, could power the equivalent of 14.8 million homes.

According to the Conference Board of Canada, a potential nuclear development in Port Hope would contribute $235 billion to Ontario’s GDP and support 10,500 jobs across Ontario, including 1,700 new, good-paying jobs.

Extending the Life of Existing Nuclear Facilities

Darlington and Bruce Refurbishment

Unit 1 at the Darlington Nuclear Generating Station has been refurbished and returned to service five months ahead of schedule, providing 875 MW of reliable, affordable and clean power for the next 30-plus years, enough to power 875,000 homes. Unit 1 is the third of four units that have been successfully refurbished to date, with the final unit tracking to be completed by 2026.

In addition, Ontario continues its project to refurbish a total of six units at the Bruce Nuclear Generating Station by 2033. Once completed, the generating capacity of the station will increase from approximately 6,550 MW to 7,000 MW of power.

Pickering Refurbishment

OPG is proceeding with the Project Definition phase of the Pickering Refurbishment project. This refurbishment would add at least 30 years of life to the Pickering “B” Nuclear Generating Station, which employs approximately 4,500 staff to support its ongoing operation. In total, there are about 7,500 jobs across Ontario related to this facility. The Pickering “B” units produce 2,000 MW of power, equivalent to powering two million homes.

Investing in Hydroelectric Energy and Storage

The Ontario government is supporting OPG’s plan to refurbish and expand hydroelectric generating stations across the province. The $4.7 billion investment will secure up to 5,000 MW of clean electricity generation, equivalent to powering five million homes, and create more than 2,000 good‑paying jobs, with more expected from two new potential stations.

The government is advancing pre-development work for the proposed Ontario Pumped Storage Project, developed in partnership by TC Energy and the Saugeen Ojibway Nation. The project, which would be the largest of its kind in Canada, would provide up to 1,000 MW of clean, affordable and reliable electricity storage — enough to power one million homes for up to 11 hours.

The Ontario Pumped Storage Project would complement other government actions, including the development of large-scale nuclear at Bruce Power. Building Bruce C would provide the large amounts of clean, zero-emissions power necessary to fill the storage facility.

Expanding the Largest Competitive Energy Procurement in Ontario’s History

The government is expanding its largest competitive energy procurement in the province’s history, to procure up to 7,500 MW of power, up from 5,000 MW as originally announced. This expansion is open to all technologies, including hydro, natural gas, energy storage, wind, and solar. It will ensure families and businesses have the reliable and affordable electricity to meet soaring energy demand.

Boosting the Electricity Grid with Hydrogen

Today, electricity, natural gas, oil and refined petroleum products are all part of Ontario's energy mix. They work together to power the economy, transport people and the goods they rely on, and heat, cool and light the homes of more than 16 million people.

While maintaining and strengthening access to affordable fuels like natural gas, which remain critical to industry, farmers and rural communities, the government is creating space for new and emerging resources like low-carbon hydrogen and renewable natural gas. Ontario is leading the way on the integration of these new technologies, including the Markham Hydrogen Demonstration Project, run by Enbridge, which on a pilot basis blends hydrogen into the natural gas system. This utility scale facility, commissioned on October 1, 2021, is the first of its kind in North America.

The Ontario government is launching a new round of the Hydrogen Innovation Fund, investing $30 million to unlock hydrogen’s potential to drive economic growth, create jobs and support the province’s position as a leader in the clean energy economy, broadening eligibility criteria to include electricity grid-focused initiatives, as well as applications across other sectors, such as transportation.

Launching Energy Efficiency Programs

The government is helping families and businesses save money and save energy by investing $10.9 billion over 12 years in energy efficiency programs, the largest investment in energy efficiency in Canadian history. Through new programs, like the Home Renovation Savings Program, the government is putting money back in people’s pockets, including rebates for upgrades like new windows, doors, heat pumps, smart thermostats and other energy saving initiatives, while benefiting Ontario’s energy system as a whole.

This investment is estimated to result in $23.1 billion in electricity system benefits, thereby saving ratepayers $12.2 billion in electricity system costs by avoiding the unnecessary build-out of new generation infrastructure.

Keeping Costs Down for Businesses

The government has taken significant steps to lower costs for businesses to help them be more competitive. Through key actions taken since 2018, the government would enable $11.9 billion in estimated cost savings and support for Ontario businesses in 2025, of which $5.6 billion would go to small businesses. Some of the actions include:

- Implementing the Ontario Made Manufacturing Investment Tax Credit, including proposing to temporarily enhance and expand it, to support manufacturing or processing investments in the province;

- Cutting the Gasoline Tax by 5.7 cents per litre and the Fuel Tax by 5.3 cents per litre, to help reduce the cost of gas and fuel for Ontario businesses;

- Supporting the reduction of Workplace Safety and Insurance Board (WSIB) rates to the lowest in half a century, which will save Ontario businesses about $150 million annually. In addition, WSIB has announced a combined $4 billion worth of rebates in surplus funds;

- Increasing the Employer Health Tax (EHT) exemption from $490,000 to $1 million. The EHT exemption increase helps businesses by reducing the tax for eligible private‐sector employers;

- Cancelling the cap‐and‐trade carbon tax to remove its cost impact from items such as gasoline, diesel fuel and natural gas;

- Lowering high Business Education Tax (BET) rates, providing $450 million in annual savings for over 200,000 employers, or 95 per cent of all business properties in Ontario;

- Reducing the small business corporate income tax rate to 3.2 per cent and expanding access to this preferential rate, helping small businesses compete and thrive by lowering their costs;

- Implementing the Regional Opportunities Investment Tax Credit to support businesses that make investments and expand in regions of Ontario that have lagged in employment growth;

- Implementing the Comprehensive Electricity Plan in January 2021, which is lowering electricity costs by an estimated average of 11 to 14 per cent in 2025 for medium‐sized and larger industrial and commercial customers, respectively; and

- Providing a six-month interest and penalty relief period for select provincially administered taxes.

In addition, the government welcomes the federal decision to set the carbon tax rate to 0 as of April 1, 2025, which effectively ends the tax. Ontario has also ended the requirement for drivers to get Drive Clean emissions tests for their light-duty vehicles; eliminated licence plate renewal fees and the requirement to have a licence plate sticker for passenger vehicles, light-duty trucks, motorcycles and mopeds; and removed tolls on Highways 412 and 418. These cuts will lower costs for businesses. Furthermore, the government will permanently remove tolls from the provincially owned Highway 407 East, effective June 1, 2025.

Eliminating the Tax on Propane for Use in Licensed Road Vehicles

Ontario is committed to cutting costly red tape so that businesses, families, and the broader economy can thrive. This is why the government is proposing to remove the tax on propane for use in licensed road vehicles, effective July 1, 2025.

Since the tax was first introduced, the use of propane vehicles has steadily declined. Eliminating the tax on propane will reduce the burden on over 1,000 businesses that sell and distribute propane for non-taxable purposes, most of which are small businesses.

Continuing to Diversify Ontario’s Economy

Diversifying Ontario’s economy by investing in innovation across key strategic sectors is crucial to building Ontario’s resilience and long-term economic growth. As U.S. tariffs threaten Ontario’s industries and businesses, innovation offers a powerful countermeasure to these economic pressures. Investments in new technologies and innovative firms will help Ontario find new markets, enhance competitiveness and drive prosperity for future generations.

Growing Ontario’s Life Sciences Strategy

The government continues to support innovation and job creation in the sector through Ontario’s Life Sciences Strategy, Taking Life Sciences to the Next Level, aimed at boosting investments and enhancing research to further solidify the province as a global leader in biomanufacturing and health sciences. Ontario is home to a thriving life sciences sector, employing more than 74,000 people in high‑value jobs across 2,000 firms, with annual exports exceeding $11.8 billion.

To date, the strategy has attracted over $6 billion in investments and created 5,000 jobs in the life sciences sector since 2018. In October 2024, Ontario announced Phase 2 of its Life Sciences Strategy, which includes a $146 million investment to help fuel the sector’s growth. Phase 2 of the strategy focuses on four key areas:

- Advancing research and development to enhance the province’s biomanufacturing capacity and capitalize on opportunities for commercialization;

- Unlocking new streams of capital that help entrepreneurs turn their ideas and prototypes into market-ready products;

- Supporting the existing ecosystem by enhancing the province’s value proposition and positioning Ontario as a premier destination for global business growth and new investments; and

- Adopting a culture of innovation so home-grown companies can leverage opportunities throughout Ontario’s health care system.

Renewing the Life Sciences Innovation Fund

As part of the Life Sciences Strategy, the government is investing an additional $15 million to renew the Life Sciences Innovation Fund (LSIF) program for three years beginning in 2025–26. The LSIF program is a co-investment fund that addresses challenges in the venture capital sector by providing early-stage funding to life sciences companies that are raising seed or pre-seed investment rounds. This investment will help support firms as they transform innovative and capital-intensive investments from conceptual stages to commercialization.

Supporting the Production of Medical Isotopes

Ontario is a global leader in producing life-saving medical isotopes, which are critical to diagnosing and treating cancer and other serious diseases. In addition to Bruce Power and other nuclear generating stations, Ontario is also home to the McMaster Nuclear Reactor, which helps drive innovation and commercialization of discoveries related to medical isotopes. As a key national research resource, the reactor supports a broad range of neutron-based research programs in strategic areas such as medical isotopes and radiopharmaceuticals.

This is why the government is investing an additional $15.5 million over three years, starting in 2025–26, to increase the reactor’s production of medical isotopes to a 24-hour-per-day, seven‑day‑per-week schedule, which will expand the supply and diversity of isotopes produced to help spur new discoveries. The investment will help create 16 new jobs by 2030, enable the creation of a commercial spinoff and joint venture for medical isotopes, and establish additional nuclear and neutron beam R&D capabilities, as well as develop and commercialize new medical treatments.

Expanding Venture Capital Investments Through Venture Ontario

Venture capital (VC) funds play an important role in stimulating entrepreneurship and economic growth by unlocking opportunities for young firms through investments into high potential, innovative companies. VC funds also offer business mentorship and access to networks that can help accelerate a company’s ability to enter new markets and succeed on a global scale. Venture Ontario, the province’s venture capital agency, makes investments into VC funds that target companies in the early-to-late stage of development and currently manages over $500 million in assets, which include investments of $300 million provided by the Ontario government in the past two years.

To continue supporting the growth of early-stage Ontario companies, the government is providing an additional $90 million in VC funding through Venture Ontario, which includes $50 million to Ontario-based VC funds focused on technologies that support national defence and related technologies such as AI and cybersecurity, and $40 million to VC funds that will help life sciences companies and biomanufacturers innovate and grow. This will help drive the development of technologies in strategic defence sectors and strengthen Ontario’s next generation biomanufacturers and medical device companies to develop the health technologies of the future. The investment will also act as a safeguard in the face of U.S.‑imposed tariffs by strengthening firm‑level competitiveness by bolstering domestic supply chains and increasing resiliency in critical sectors of the economy.

Investing in Research Infrastructure to Support Economic Growth

Developing robust research and innovation capacity through institutions, such as universities, colleges and hospitals is integral to ensuring Ontario remains competitive on the global stage. This is why the government is investing an additional $207 million over three years through the Ontario Research Fund – Research Infrastructure (ORF-RI), starting in 2025–26, to provide Ontario institutions with funding to acquire infrastructure and engage in global R&D. This will help support Ontario’s competitiveness in attracting, retaining and developing leading talent by ensuring researchers continue to have the state-of-the art facilities and equipment needed to make groundbreaking discoveries, drive the economy and improve the lives of people in Ontario. This investment will also leverage federal investments towards infrastructure projects in the province.

Past investments in ORF-RI have significantly contributed to Ontario’s strength in research and innovation across key government priorities, such as life sciences, autonomous vehicles and critical minerals. Since 2018–19, Ontario’s investment of $560 million has leveraged $930 million and helped train over 73,800 highly qualified personnel.

Making Ontario a Global Leader in Artificial Intelligence

The province is home to many “firsts,” including being the birthplace of modern AI, which was pioneered at the University of Toronto more than 30 years ago. Most recently, advances in large language models have resulted in an explosion of generative AI tools that have the potential to transform economies and societies worldwide by driving growth, productivity and new opportunities in many industries.

With nearly 400 AI firms, more than $1.5 billion in AI-related venture capital investments, and more than 1,100 recent AI master’s degree graduates, Ontario offers a dynamic ecosystem and immense potential for additional growth and innovation. Ontario is committed to maintaining its place as a global leader in AI development.

Fostering the Artificial Intelligence Ecosystem

Like AI applications themselves, a strong AI ecosystem relies on the multitude of nodes and connections that combine to produce an innovative environment. Investing in AI, like other critical technologies such as 5G, blockchain, cybersecurity, quantum and robotics, will help Ontario firms to capitalize on new and emerging global market opportunities across key economic sectors and industries. Ontario’s $107 million Critical Technologies Initiative includes flagship investments of up to $27 million in the Vector Institute for Artificial Intelligence, a variety of projects through the Ontario Centre of Innovation, and the Ontario Bioscience Innovation Organization. This will enable companies to adopt, develop and bring new AI technologies to market. In addition, Ontario has committed more than $65 million for the province’s Advanced Research Computing (ARC) systems, which provide critical resources for researchers in Ontario to ensure the systems meet the storage and computational demands for research into technologies such as AI.

Committing to Safe and Responsible Use of Artificial Intelligence

Ontario is also committed to safeguarding public interest against new emerging risks, including discrimination, surveillance, and threats to personal privacy. Through the Strengthening Cyber Security and Building Trust in the Public Sector Act, 2024, the government is laying the foundation for Ontario’s AI future by establishing AI governance within the broader public sector and ensuring data security and trust in digital tools.

The Ontario government is already leveraging AI in multiple ways to increase efficiency and improve services. This includes using AI to analyze data, monitor air and water quality to predict risks, support predictive soil mapping, and develop chatbots/virtual assistants and AI scribes. Looking ahead, the government is examining how AI can be safely and securely leveraged to further accelerate the identification and implementation of red tape reduction.

Developing and Attracting Top Artificial Intelligence Talent

Ontario’s postsecondary institutions are adapting quickly to supply the labour market with AI talent, with over 1,700 new AI master’s degree and study path enrolments underway at more than 25 AI‑focused master’s programs across 11 universities. Ontario talent is increasingly recognized by global businesses outside the traditional tech industry looking to embrace AI in their operations. In the past year, Invest Ontario has announced $1.2 billion in investments that will leverage Ontario’s AI expertise for the life sciences, transit infrastructure and EV industries.

For example, in November 2024 in Toronto, Ontario welcomed an investment of over $100 million by Hitachi Rail, a leader in the global transportation ecosystem, to upgrade their communications‑based train control (CBTC) signalling technology with AI, 5G, and cloud computing.

In the same month, the Ontario government welcomed the expansion of Hoffmann-La Roche Limited’s Global Informatics division at the company’s Mississauga headquarters (Roche Canada). This investment equates to more than $130 million over five years and was supported by a $3.5 million provincial investment through Invest Ontario. The initiative will create up to 250 new, good-paying jobs, drive innovation and accelerate the delivery of groundbreaking health solutions to patients across Ontario.

Supporting Ontario’s Forest Sector

Forestry and forest products are an important driver of the province’s economy. Ontario’s Crown forests cover almost two‐thirds of the province, attracting investment in the industry and providing economic opportunities that create jobs. The forest industry is a key supporter of Indigenous, Northern and rural communities in Ontario and the government is committed to sustainably managing and promoting the responsible use of Ontario’s forest sector, allowing the people of Ontario to benefit from the health and wealth of the province’s natural resources.

Building Resiliency in Ontario’s Forest Sector

Ontario is continuing to help the forest sector build long-term resiliency in response to the current economic environment. This includes investing $6 million in 2025−26 to expand Forest Access Roads in Northern Ontario to help build and maintain multi-use roads in Crown forests, supporting economic development and providing needed infrastructure for the public, Indigenous communities and commercial users. Ontario is also investing an additional $2.4 million over three years, beginning in 2025−26, to allow the ongoing implementation of the Forest Sector Strategy through innovative construction projects with industry partners, leading to higher utilization of Crown timber harvested, increased revenues, and the stimulation of economic activity in the sector.

Ontario is continuing to make investments in forest sector initiatives to develop the economic potential and environmental benefits of underutilized wood and mill byproducts, known as forest biomass. Through the $60 million Forest Biomass Program, Ontario is working to:

- expand the volume of wood harvested from Crown forests for use in traditional and innovative products and applications;

- support the sustainability of forest product operations and the contribution the forest sector makes to regional economies, including employment and revenues generated by forest product manufacturing facilities; and

- work with municipalities, industry, Indigenous communities and stakeholders to collaboratively identify and invest in viable future uses for wood.

Strengthening Ontario’s Agri-Food Sector

Ontario has a rich and diverse agri‐food sector that produces over 200 agricultural commodities, with 60 per cent of the food produced in Ontario being processed and consumed right in the province. In November 2022, the government released Grow Ontario: a provincial agri‐food strategy to strengthen agri-food supply chains, attract and grow Ontario’s agri-food talent, as well as support the adoption of new technologies and practices that enhance competitiveness.

Promoting Agri-Food Stability Through Ontario’s Risk Management Program

Ontario’s Risk Management Program (RMP), including Self-Directed Risk Management (SDRM), helps Ontario farmers compete globally by providing support for risks beyond their control. This helps ensure the predictability and stability needed for agri-food businesses to invest and grow at a time when the threat of tariffs and other market instability on the sector is creating additional risks. In January 2025, Ontario announced an increase in annual funding for the RMP, from $150 million to $250 million over a three-year period, starting with a $30 million increase for the 2025 program year.

Increasing Ontario’s RMP will support farmers in responding to market challenges while boosting their long-term business confidence and competitiveness. The RMP supports over 383,000 jobs and $24 billion throughout Ontario’s agri-food supply chain across 8,500 farms, when they are facing challenges such as fluctuating market prices and extreme weather events like flooding, drought or disease.

Enhancing Ontario Grape and Wine Production

Ontario’s grape and wine industry is an important part of the province’s economy, and the government is committed to see it grow and thrive. The government continues to further its commitment to support local economic development by providing a range of transitional and time-limited supports for Ontario’s grape farmers and wine sector. The government will always put people and businesses first and do what is best for Ontario workers and the economy.

The government is introducing the Ontario Grape Support Program that will help Ontario grape farmers and wineries by increasing the number of Ontario grapes in bottles of wine. The program will provide up to $35 million in annual support to eligible wineries over five years, beginning in 2025–26 until 2029–30, with total program funding amounting to $175 million. At full implementation, this program is anticipated to double, on average, the percentage of Ontario grapes in blended wine, leading to the purchase of thousands of additional tonnes of Ontario grapes from grape farmers.

As part of the government’s continued support for Ontario’s world-class VQA wines, which generate millions in sales annually, the government is also extending the VQA Wine Support Program until 2029–30 and enhancing program eligibility to include ice wines, as well as VQA wine sold in convenience stores and on-site winery retail stores. These program enhancements will provide additional support to VQA wine producers, expanding the total support to $84 million in annual support, with total program funding amounting to $420 million over the next five years.

In addition, the government is introducing the Wine Boutique Support Program that will provide up to $16.7 million over five years, beginning in 2025–26 until 2029–30, to support a portion of capital expenses for off-site winery retail stores that re-locate into grocery stores, supporting more opportunities for business and convenience for consumers.

To further support the grape and wine sector, the government has directed the Liquor Control Board of Ontario (LCBO) to promote and prioritize small and Ontario-made products and producers by providing more and enhanced programs to help these businesses further contribute to Ontario’s economy.

Strengthening Ontario’s Tourism Sector

Ontario is continuing to support its tourism sector to help grow the economy, create jobs and highlight the province as a global travel destination of choice.

Supporting Destination Wasaga

Ontario is supporting the Town of Wasaga Beach to realize their bold tourism vision and economic plan by making available $2 million in tourism planning and almost $25 million in capital funding over two years, beginning in 2025–26, to support the revitalization of the province’s Nancy Island Historic Site.

Supporting Destination Niagara

Niagara Region attracts more than 13 million tourists each year, resulting in a $3 billion tourism industry, representing a 6 per cent share of the region’s GDP.

Ontario is working on a comprehensive plan to support the economic potential of the Niagara Region as a tourism driver by bringing new attractions and accommodations. This includes investing more than $35 million over three years to support the Shaw Festival, and the redevelopment of the Toronto Power Generating Station into the region’s only five-star hotel, which is funded entirely through a more than $200 million private-sector investment.

In addition, the plan would also explore opportunities to continue to grow the existing gaming market and improve transportation convenience, as well as continue to work with the tourism sector on marketing opportunities.

Ontario is also launching a study to better understand the opportunities to improve air access to the Niagara Region. The study will be supported through engagement with air carriers, Transport Canada, other federal agencies, and municipalities. It will assess opportunities and demand for air travel to Niagara Region, as well as examine how existing infrastructure, including airports, can be used to address transportation needs and encourage tourism and economic growth.

Growing Ontario’s Northern and Rural Economies

The success of Ontario depends on the growth and sustainability of all its regions, including Northern Ontario and rural communities across Ontario. The government continues to ensure all regions receive the support and resources they need to thrive, while building the province’s overall prosperity.

Tackling New Challenges for Rural Ontario Through the Rural Economic Development Strategy

The government continues to take action to unleash the economic potential of rural and Northern Ontario, crucial to the province’s overall prosperity. In January 2025, the government announced Enabling Opportunity: Ontario’s Rural Economic Development Strategy that will help support economic growth, workforce capacity and business development in rural communities.

As part of the strategy, the government has replaced its previous Rural Economic Development (RED) program with the new Rural Ontario Development (ROD) program and is doubling its funding to $10 million annually over the next two years, starting in 2025–26, for a total of $20 million. The program provides cost-share funding aimed at creating strong rural communities in Ontario and opening doors to rural economic development, by funding projects that support communities, rural businesses and entrepreneurs in addressing barriers to business development and growth.

Increasing the Ontario Municipal Partnership Fund

As announced in fall 2024, the government is increasing the Ontario Municipal Partnership Fund (OMPF) by $100 million over two years, bringing the total envelope to $600 million by 2026. As part of this approach, municipalities are already benefiting from an immediate $50 million increase to the OMPF in 2025, including new minimum base top-up funding to provide stability and predictability for very small Northern and rural municipalities. The enhancement to the OMPF will help municipalities in providing critical services in their communities. Later this spring, the Ministry of Finance will be consulting with municipalities on their priorities for the program, as well as the implementation of a new reporting framework.

Expanding the Northern Ontario Heritage Fund Corporation

The government continues to support economic development in Northern communities through the Northern Ontario Heritage Fund Corporation (NOHFC). The NOHFC provides financial assistance to projects that help stimulate job creation and workforce development, benefiting communities of all sizes, both rural and urban, as well as Indigenous communities in Northern Ontario.

In January 2025, the government announced an investment of an additional $30 million over three years beginning in 2025–26, bringing the NOHFC’s annual budget to a total of $110 million. This funding will serve as a catalyst for economic development and growth in the North, including the expansion of programming eligibility to include the District of Muskoka. Since June 2018, the NOHFC has invested more than $905 million in over 7,000 projects in Northern Ontario, leveraging more than $2.8 billion in investment and creating or sustaining over 11,000 jobs.

Helping Entrepreneurs Start and Grow Their Businesses

Small businesses and entrepreneurs are a critical part of Ontario’s plan to grow the economy. The government understands that small business owners have unique needs when looking to start and grow their businesses. In light of U.S. tariffs, the government is providing businesses with strategic supports to help them adapt and remain competitive.

Boosting Entrepreneurship and Small Business Growth

Ontario’s network of 47 Small Business Enterprise Centres (SBECs) provide entrepreneurs with a full range of business support services. These centres provide one‐stop access to advisors, programs and services, as well as learning opportunities for small business owners specific to their region. The government is investing $1.9 million over three years, starting in 2025–26, to establish a business succession planning services hub within the SBEC network, which will provide support to entrepreneurs looking to sell their businesses or buy new ones.

In addition, the government is providing $2 million in 2025–26 to Futurpreneur Canada to help young entrepreneurs achieve their business goals. Futurpreneur Canada helps entrepreneurs aged 18 to 39 with mentorship, in-person programming, and loan capital worth up to $25,000 from Futurpreneur Canada and up to $50,000 from the Business Development Bank of Canada (BDC). In 2023–24, Futurpreneur supported 294 businesses in Ontario, including 74 in Northern, rural and remote communities.

The government is also continuing its support of the Digitalization Competence Centre (DCC) through an investment of $7.5 million in 2025–26. Delivered by the Ontario Centre of Innovation, the DCC supports SMEs in adopting and implementing digital technologies to stay competitive in an ever-increasingly digital marketplace. This funding will support the DCC’s programs that enhance digital literacy through education, coaching and training and help accelerate digital adoption. It would also support SMEs through grants to adopt new equipment and processes and leverage digital solutions to achieve business efficiencies, increasing their competitiveness and helping them to reach their full potential.

Helping Grow Ontario’s Cannabis Sector

All cannabis products sold by the Ontario Cannabis Store (OCS) are grown, processed and packaged in Canada. The Ontario government is further supporting locally grown cannabis by creating a new Ontario Grown Cannabis badge. Licensed cannabis producers can use this badge to help retailers and consumers identify and purchase locally grown products in Ontario. Starting in summer 2025, the OCS will issue the badge, to be featured on certain products with minimum 75 per cent grown-in-Ontario inputs, making it easier for retailers to identify and stock products that support Ontario’s and Canada’s economy.

To increase the comfort, security and safety of both customers and employees of licensed cannabis retail stores, changes are being made to allow stores to improve their outside visibility. These changes are intended to support legitimate local businesses by enhancing transparency and fostering a more welcoming environment for consumers, while still protecting youth from exposure to cannabis.

Ontario welcomes the federal announcement to explore a transition from cannabis excise duty stamps specific to each province and territory to a single national stamp, for which Ontario has also advocated. A single national stamp would make it easier for cannabis producers, especially smaller producers, to sell their products across Canada. Ontario is committed to collaborating with federal partners to continue assessing opportunities to reduce red tape and support Canada’s legal cannabis industry.

The government is helping Ontario’s legal cannabis sector grow, so it is best positioned to continue displacing the illegal market.

Increasing Competition and Capital Formation

The Ontario government is working with key partners, including the Ontario Securities Commission (OSC) and the Canadian Investment Regulatory Organization (CIRO), to implement measures designed to promote capital formation and economic growth, enhance access to investment opportunities, and maintain market integrity and investor protection.

To increase competition and facilitate capital formation for Ontario businesses, the OSC, in coordination with other Canadian regulators, is:

- Allowing companies that go public to provide audited financial statements for two years, instead of three years;

- Facilitating cost-effective capital raising for new reporting issuers for the 12 months after an Initial Public Offering (IPO); and

- Permitting proceeds from the disposition of certain investments to be reinvested above the current investment limit maximum under the Offering Memorandum Prospectus Exemption.

Increasing Long-Term Investment Opportunities for Retail Investors

The OSC recently concluded a stakeholder consultation on long-term asset funds (LTAFs) and is engaging with industry to accelerate bringing to market novel applications for LTAF structures. Frameworks for retail investment in long-term assets exist in other international jurisdictions and facilitating broader access to those types of investment products in Canada would contribute both to increased investment opportunities for retail investors and building necessary infrastructure.

The government supports options for interested retail investors to diversify their portfolios and looks forward to the OSC’s next steps.

Enabling Credit Unions to Raise Alternative Capital

Ontario’s credit unions and caisses populaires play important roles in providing financial services to the people of Ontario and businesses in urban and rural communities.

To bolster their ability to compete and grow, the government intends to consult on providing Ontario credit unions the ability to raise capital outside of their membership by selling investment shares to non‑members.

This would allow credit unions to access public and private capital markets, providing them with long-term sources of capital. The government will continue working closely with stakeholders and regulators to support the growth of Ontario’s credit union sector.

Toughening Up on Short Selling

The government continues to support the OSC and CIRO in strengthening the short selling regime in Ontario to protect market integrity. As part of this work, CIRO has proposed a mandatory close-out requirement designed to mitigate the occurrence of failed trades while the OSC is working on proposed rule amendments to prohibit short selling in connection with a prospectus offering or private placement. These measures would help mitigate against potential stock price manipulation actions, and would support junior mining companies listed on Ontario stock exchanges.

Strengthening Enforcement and Investor Protection

The government is further strengthening the OSC’s and CIRO’s investigation and enforcement tools to better protect investors and increase confidence in Ontario’s capital markets. Specifically, the government is introducing legislative amendments to empower CIRO with statutory authority to compel evidence in CIRO’s investigations and disciplinary hearings and to provide CIRO staff with immunity for good-faith actions. To further deter bad actors from operating in Ontario’s capital markets, the government is increasing the maximum amounts for administrative monetary penalties and certain fines to $5 million and $10 million, respectively.

Protecting Workers

Ontario’s workers remain one of the province’s most valuable assets, and the government is taking action to protect them against U.S. tariffs and economic uncertainty, while continuing to make it easier for workers to get the skills they need for better jobs and bigger paycheques. The provincial government is making greater investments to support major industries and sectors expected to grow in the coming years, as well as those that may face pressures from U.S. tariffs, while helping to prepare the workers needed to build and strengthen Ontario’s economy.

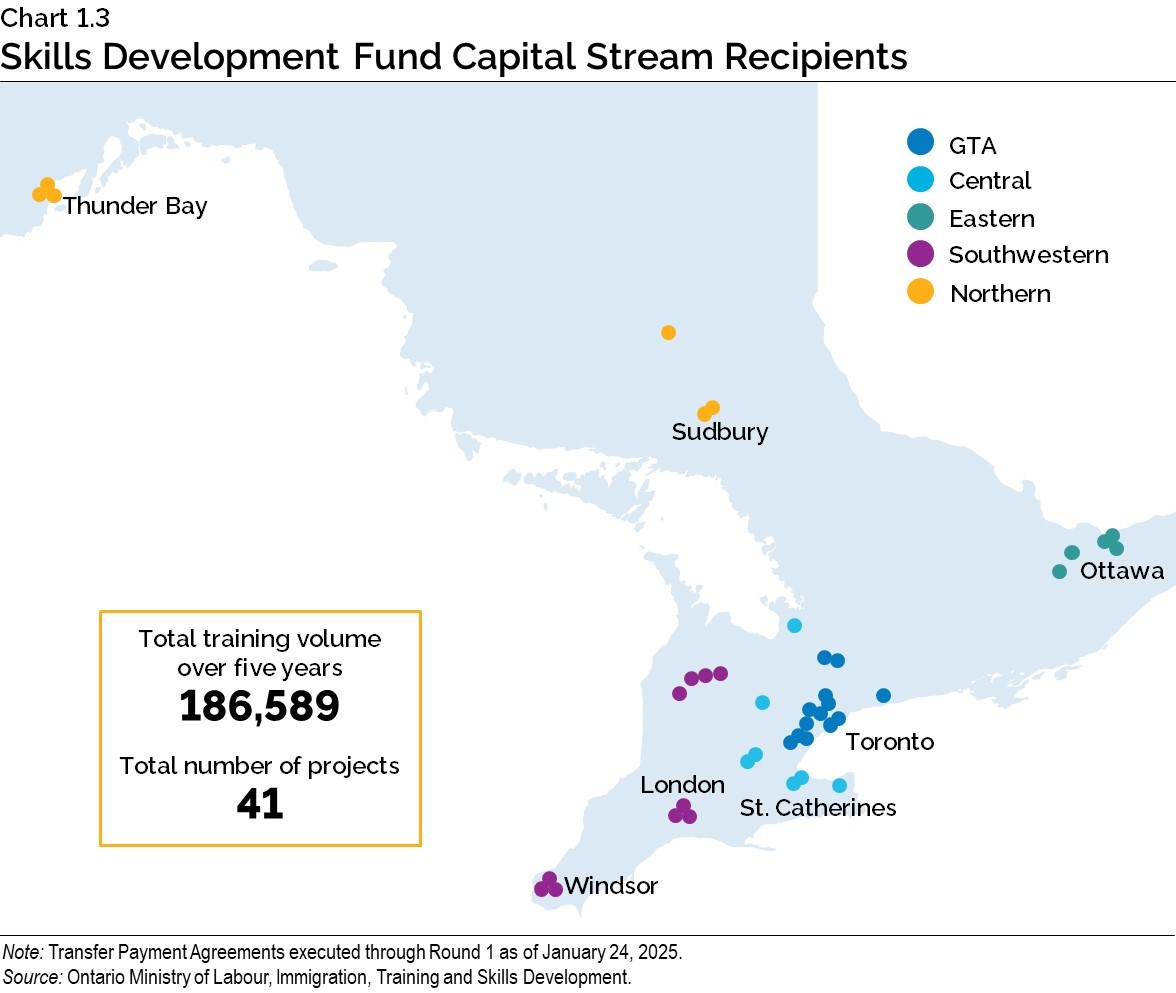

Training Workers for Rewarding Careers Through the Skills Development Fund

At a time when U.S. tariffs and policies threaten Ontario’s economic prosperity, Ontario will do whatever it takes to protect the province’s greatest competitive advantage: its highly skilled, world-class workforce. This is why the government is working to ensure that skilled workers across Ontario have the training they need to enter rewarding careers in priority sectors through the Skills Development Fund (SDF). The investments made through SDF help organizations deliver better training programs and upgrade and build new training centres across the province. The government has invested $1.5 billion through the Training and Capital SDF streams, training over 930,000 workers for in-demand careers in every corner of the province. Over the next three years, the government is investing another $1 billion, bringing the total SDF funding commitment to $2.5 billion.

This new $1 billion dollar investment includes $100 million that was announced in January 2025 for the SDF Training Stream, as well as $705 million over the next three years being introduced through this Budget. SDF training funding can be used to help offer training programs and skills development in partnership with unions, businesses, and other associations.

The government is also providing $150 million over three years starting in 2025–26 to support increased demands in the SDF Capital Stream. The SDF Capital Stream, first launched in 2023, supports the building, expansion and retrofitting of training facilities.

Helping Job Seekers Train for In-Demand Jobs

The Better Jobs Ontario program helps eligible job seekers transition to in-demand jobs, by providing financial support to cover expenses like tuition, transportation, and child care. Since January 2021, this program has supported nearly 16,0001 job seekers looking to retrain. The government is investing an additional $50 million into the program in 2025−26 to support vocational and skills training that will enable more people to transition into in-demand jobs and support key labour market needs. This new funding will include a fast-track stream for job seekers in trade-impacted sectors, helping to protect workers in the face of U.S. tariffs. By investing further in the Better Jobs Ontario program, the Ontario government is helping workers land better jobs and become part of a strong and resilient Ontario workforce.

Supporting Rewarding Careers in the Skilled Trades

The government continues to attract people in Ontario to rewarding careers in the skilled trades by supporting a variety of programs that focus on breaking the stigma and attracting more young people, simplifying the system, and encouraging employer participation. Since 2020, Ontario has invested over $2.1 billion in the skilled trades. These investments help support Ontario’s economy during a time of uncertainty caused by the U.S. tariffs.

Ontario is investing an additional $159.3 million over three years to support ongoing growth and program stability in various skilled trades programs, including expanding the In-Class Enhancement Fund to increase the number of training seats available and fund the classroom fees for Level 1 apprentices. This investment will continue attracting people to careers in the skilled trades and support them on their journey to become experienced journeypersons.

Enrolling More Students in Construction-Related Postsecondary Programs

Ontario is investing $75 million over three years to create up to 2,600 new seats annually in priority construction-related postsecondary programs. This investment will increase the supply of students for in-demand jobs to meet current and projected labour demand in sectors that are critical to deliver Ontario’s ambitious infrastructure plan.

Supporting Science, Technology, Engineering and Mathematics in Postsecondary Education

The government is continuing to be responsive to the increasing labour market demand for workers in sectors related to Science, Technology, Engineering and Mathematics (STEM). This is why the government is providing $750 million over five years to fund up to 20,500 STEM seats per year at publicly assisted colleges and universities. This investment in STEM education will help build a skilled, made-in-Ontario talent pool and strengthen the province’s key sectors, such as advanced manufacturing, life sciences and artificial intelligence.

Supporting Small, Northern and Rural Postsecondary Institutions

The government remains committed to ensuring that small, Northern and rural colleges and Northern universities can provide students with competitive choices for local postsecondary education. This is why the government is continuing to provide an additional $10 million in funding in 2025−26 to provide targeted support to eligible publicly assisted postsecondary institutions based on need.

Expanding Ontario’s Teaching Workforce

The government is addressing the need for qualified teachers by ensuring the public education system has a stable supply of English- and French-language teachers across the province to support and improve student outcomes. Ontario is investing $55.8 million over two years to train 2,600 new teachers by 2027. These efforts will provide a steady stream of qualified teachers to support students’ academic achievement and future career success.

Empowering Black Youth and Young Professionals

Ontario continues to invest in the Black Youth Action Plan by providing $16.5 million in 2025–26 to help Black youth develop the skills needed to launch and advance their careers in high-demand sectors such as the skilled trades, information technology, automotive, health, film and the arts. Since its launch, the Black Youth Action Plan’s Economic Empowerment Stream has helped over 19,000 youth to pursue educational and career success and partnered with more than 190 organizations. This initiative will provide community organizations and Black-led businesses with the resources needed to continue providing services to children, youth and families.

Creating More Pension Options for Workers

The government implemented a legislative and regulatory framework for target benefits on January 1, 2025, following consultations with the sector. Target benefit pension plans provide workers with a lifetime stream of income in retirement at a predictable cost for employers. Members of these plans can move from employer to employer while continuing to participate in the same pension plan.

As pension plans begin operating under the target benefit framework, the government will monitor the new regime to ensure that it is working as intended and meeting the needs of all plan members.

In addition, the government is consulting with the pension sector on a possible new pension option called a Variable Life Benefit (VLB). A VLB would be paid from pooled registered pension plans, defined contribution pension plans, and those pension plans that provide for additional voluntary contributions. A VLB would give retirees a new alternative by providing a monthly benefit for life, with payments that are adjusted based on the investment performance of the fund and mortality experience of the fund’s members.

The government is evaluating the feedback from stakeholders, which will help inform a future VLB legislative framework.

Footnotes

[1] As of April 2025.

Chart Descriptions

Chart 1.2: Supporting Ontario Businesses

This bar chart illustrates that Ontario businesses are expected to receive $11.9 billion in estimated cost savings and support in 2025. This includes combined support from lowering payroll costs ($7.2 billion), providing electricity and other price relief ($1.8 billion), providing income, property and other tax relief ($1.3 billion), and cancelling the cap-and-trade carbon tax ($1.6 billion).

Notes: Lowering payroll costs includes supporting Workplace Safety and Insurance Board (WSIB) premium reductions, increasing the Employer Health Tax (EHT) exemption to $1 million starting in 2020 and changing the minimum wage. Providing electricity and other price relief represents lowering electricity prices through the Comprehensive Electricity Plan; reducing Liquor Control Board of Ontario (LCBO) wholesale prices for liquor sales, licensees, licensed convenience stores, and eligible LCBO Convenience Outlets; direct savings to businesses from extending the 5.7 cent per litre cut to the Gasoline Tax and the 5.3 cent per litre cut to the Fuel Tax until June 30, 2025, and from making those cuts permanent as of July 1, 2025. Providing income, property and other tax relief includes reducing Ontario’s small business corporate income tax rate to 3.2 per cent and expanding access to this preferential rate; implementing the Regional Opportunities Investment Tax Credit; implementing, enhancing and expanding the Ontario Made Manufacturing Investment Tax Credit; lowering high Business Education Tax (BET) rates; not paralleling the federal tax increase on some small businesses earning passive investment income; and providing a six-month interest and penalty relief period for select provincially administered taxes. Totals may not add due to rounding.

Source: Ontario Ministry of Finance.

Chart 1.3: Skills Development Fund Capital Stream Recipients

The map of Ontario displays the location of projects where Transfer Payment Agreements have been executed through Round 1 of the Skills Development Fund Capital Stream as of January 24, 2025. The size of the dots reflects the number of projects per location, ranging from 1 to 3 projects. The dots are colour-coded by the five Ontario regions: the Greater Toronto Area (GTA), Central, Eastern, Southwestern and Northern. The total number of projects is 41, of which 13 are located in the GTA, 7 are in Central Ontario, 5 are in Eastern Ontario, 10 are in Southwestern Ontario and 6 are in Northern Ontario. The total training volume over five years is 186,589.

Source: Ontario Ministry of Labour, Immigration, Training and Skills Development.